All Categories

Featured

Table of Contents

That typically makes them a much more economical choice for life insurance policy coverage. Several individuals obtain life insurance policy coverage to assist economically safeguard their liked ones in situation of their unforeseen death.

Or you may have the choice to transform your existing term coverage right into a permanent policy that lasts the remainder of your life. Different life insurance policy policies have possible advantages and downsides, so it's vital to understand each prior to you determine to purchase a plan.

As long as you pay the premium, your recipients will receive the death benefit if you pass away while covered. That said, it's crucial to note that the majority of plans are contestable for 2 years which suggests coverage could be retracted on fatality, should a misrepresentation be located in the application. Policies that are not contestable usually have a rated survivor benefit.

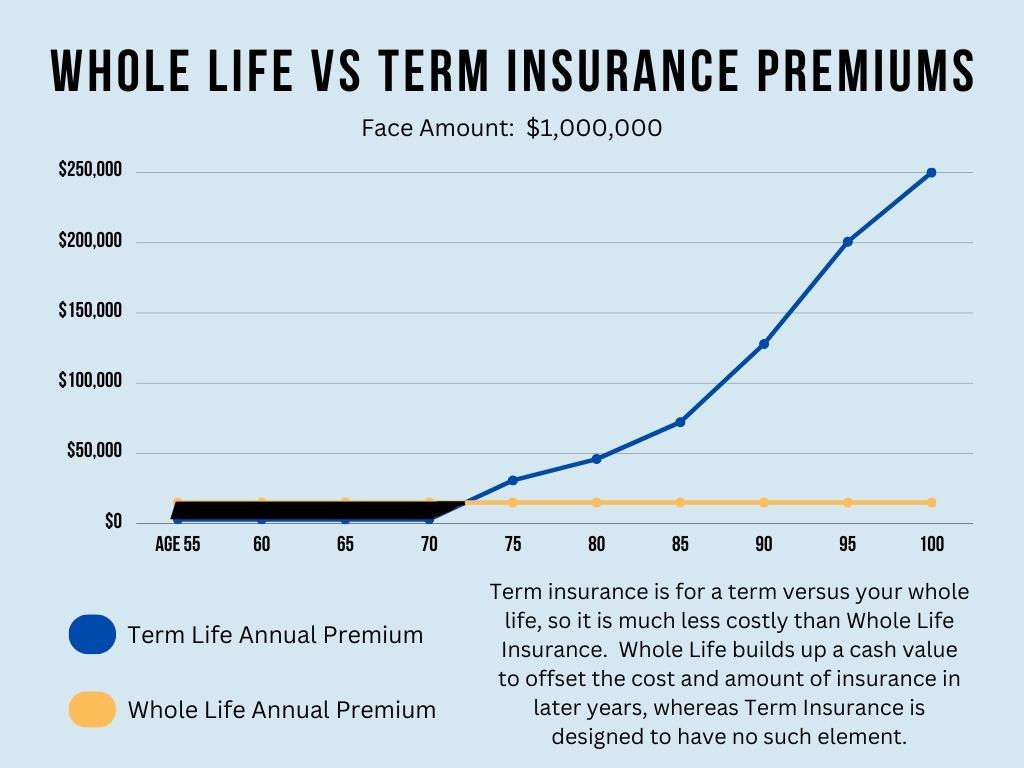

Premiums are usually lower than whole life plans. With a level term plan, you can select your protection amount and the plan length. You're not secured right into an agreement for the remainder of your life. Throughout your policy, you never need to bother with the premium or fatality benefit quantities altering.

And you can not squander your plan during its term, so you won't get any financial take advantage of your past protection. As with other kinds of life insurance policy, the price of a level term policy relies on your age, protection demands, work, way of life and health. Typically, you'll locate a lot more inexpensive insurance coverage if you're younger, healthier and much less dangerous to guarantee.

Guaranteed Term Vs Universal Life Insurance

Since level term premiums remain the very same for the duration of insurance coverage, you'll know specifically just how much you'll pay each time. Degree term protection also has some versatility, enabling you to personalize your plan with added attributes.

You may have to fulfill certain conditions and qualifications for your insurance provider to pass this biker. Furthermore, there may be a waiting period of up to 6 months before taking result. There likewise could be an age or time frame on the coverage. You can add a youngster cyclist to your life insurance coverage policy so it also covers your children.

The survivor benefit is generally smaller, and protection generally lasts up until your kid transforms 18 or 25. This cyclist may be a much more affordable method to help ensure your children are covered as riders can frequently cover multiple dependents simultaneously. When your child ages out of this coverage, it may be feasible to transform the rider into a new plan.

The most typical kind of irreversible life insurance is whole life insurance coverage, however it has some vital distinctions contrasted to degree term insurance coverage. Below's a standard review of what to take into consideration when contrasting term vs.

Expert What Is Direct Term Life Insurance

Whole life entire lasts insurance coverage life, while term coverage lasts insurance coverage a specific periodParticular The premiums for term life insurance coverage are normally reduced than entire life protection.

One of the highlights of level term insurance coverage is that your costs and your fatality benefit do not alter. With reducing term life insurance policy, your costs remain the very same; nevertheless, the survivor benefit quantity gets smaller sized with time. For instance, you may have coverage that starts with a fatality benefit of $10,000, which can cover a home mortgage, and afterwards yearly, the survivor benefit will reduce by a set amount or portion.

Due to this, it's usually a much more affordable kind of level term insurance coverage. You might have life insurance policy via your company, but it might not be adequate life insurance policy for your requirements. The primary step when buying a plan is determining just how much life insurance you require. Consider elements such as: Age Family members size and ages Work standing Income Debt Way of living Expected final expenditures A life insurance policy calculator can aid figure out just how much you need to begin.

After choosing on a policy, complete the application. If you're authorized, sign the documents and pay your first premium.

Innovative Term Life Insurance For Couples

You may want to update your beneficiary information if you have actually had any type of significant life modifications, such as a marriage, birth or divorce. Life insurance policy can often feel complicated.

No, degree term life insurance policy doesn't have cash value. Some life insurance policy plans have an investment function that permits you to construct money value in time. A part of your premium repayments is reserved and can gain interest in time, which grows tax-deferred during the life of your insurance coverage.

You have some alternatives if you still want some life insurance protection. You can: If you're 65 and your insurance coverage has actually run out, for example, you may want to purchase a brand-new 10-year degree term life insurance plan.

Term Vs Universal Life Insurance

You might have the ability to transform your term insurance coverage into a whole life policy that will last for the rest of your life. Many types of degree term plans are exchangeable. That implies, at the end of your coverage, you can transform some or every one of your policy to whole life coverage.

Degree term life insurance policy is a policy that lasts a set term typically in between 10 and thirty years and comes with a level fatality benefit and degree premiums that remain the same for the whole time the policy holds. This implies you'll know specifically just how much your settlements are and when you'll have to make them, enabling you to budget plan appropriately.

Degree term can be a fantastic alternative if you're wanting to acquire life insurance policy protection for the first time. According to LIMRA's 2023 Insurance coverage Measure Research Study, 30% of all grownups in the U.S. need life insurance policy and do not have any kind of type of plan. Level term life is foreseeable and economical, that makes it among one of the most preferred kinds of life insurance policy.

Latest Posts

Final Expense Insurance Definition

United Funeral Directors Benefit Life Insurance Company

Globe Life Final Expense Insurance Reviews